Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Managed by professionals, they offer a way to invest in a variety of assets without buying them individually. Investors own shares in the fund, and returns depend on the fund’s performance.

Equity Funds

Equity funds are investment funds that primarily invest in stocks or equity securities, providing investors with a share of ownership in a diversified portfolio of companies.

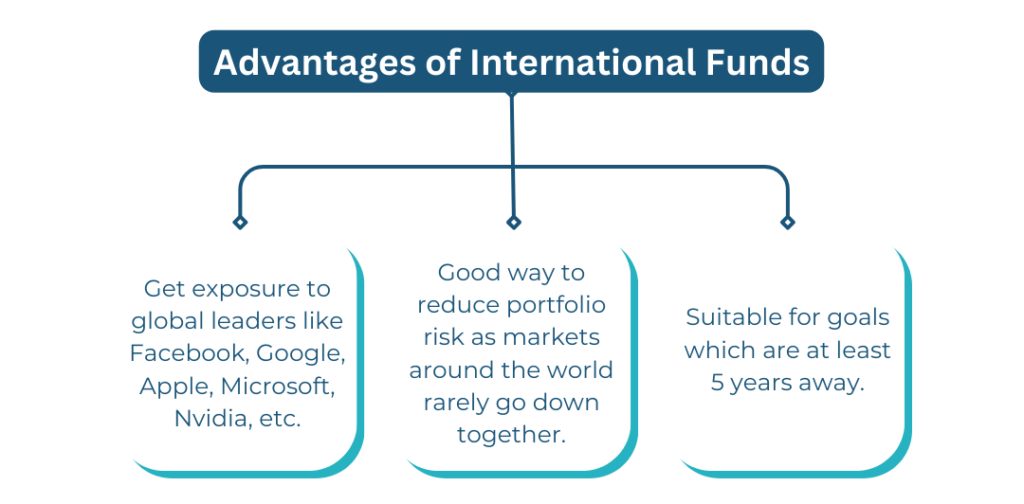

International Funds

International funds invest in stocks of companies listed outside of India. These funds help you invest in some of the biggest companies in the world.

Debt Funds

Debt funds invest in fixed income instruments like treasury bills, corporate bonds, government securities, and many other money market instruments. All these instruments have a pre-decided maturity date & interest rate.

Hybrid Funds

Hybrid funds, also known as balanced funds, aim to provide diversification by investing in both equity and debt instruments, offering investors a balanced approach to capital appreciation and income generation.

Gold & Silver Funds

Gold and silver funds are investment vehicles that allow investors to gain exposure to the prices of gold and silver, typically by investing in physical metals or related financial instruments, providing a way to diversify portfolios and hedge against inflation or economic uncertainties.